Unlocking the Secrets of Letter of Credit: Understanding SBLC and Irrevocable Letters

7 Dec 2023

25 Jun 2020

min read

A Letter of Credit, a Standby Letter of Credit and an Irrevocable Letter of Credit sound extremely similar, but are they similar in nature or are they wholly different? These bank letters of credit have been used in commercial trade transactions for a long time. They come in two basic types – Documentary Letters of Credit (which are also known as Commercial Letters of Credit) and Standby Letters of Credit. While they share a similar name and both types of letters are created to assure the parties in a commercial transaction that contractual obligations will be honoured, the two have fundamental differences and have distinct purposes.

A. Difference between Letter of Credit and Standby Letter of Credit

1. What is a Letter of Credit?

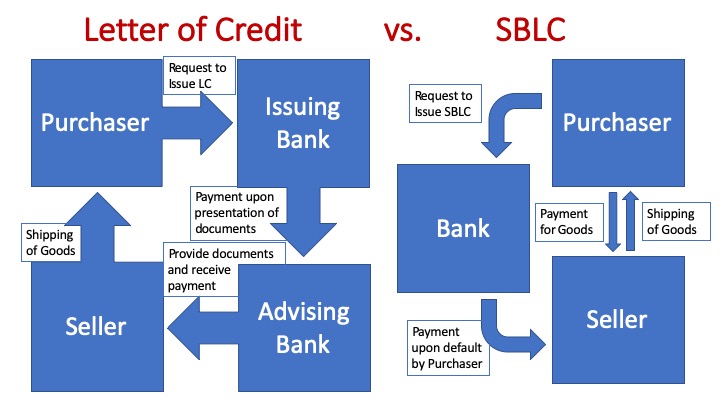

A Letter of Credit is also known as Documentary Credit, a primary payment method given to the seller by the purchaser for trading purposes. This type of letter is essentially an assurance from the purchaser's bank (also known as the issuing bank / remitting bank) that the bank will pay the full amount under the letter of credit on sight.

The issuing bank will pay against the presentment of certain shipping documents (generally a clean bill of lading and/or other shipping documents such as a packing order) by the seller. The issuing bank will pay the seller's bank (also known as the collecting bank/advising bank) the funds that were obtained from the purchaser at the sight of a complying presentation in accordance with the terms and conditions of the letter of credit.

Documentary Letters of Credit are irrevocable and constitute a definite undertaking of the issuing bank to honour a complying obligation. They are mainly used as a payment method in international trades, for the export and import of tangible goods.

They are used to promote trust in transactions, especially for international dealings which involve factors of distance, knowledge of each other and differences in legal systems between the parties.

2. What is a Standby Letter of Credit (SBLC)?

On the other hand, a Standby Letter of Credit is also known by its abbreviation “SBLC”. It is essentially an assurance from the purchaser's bank that the purchaser will fulfil its obligation and pay the full amount on time. It is a secondary payment method that acts more as a guarantee in transactions.

It is used in situations where the bank guarantees the purchaser's payment when the terms of the letter are fulfilled by the seller. Thus, the bank has the duty to ensure that the purchaser pays. If the purchaser is unable to fulfil its paying obligation, the seller can draw from the SBLC and the bank will pay the seller the funds that were owed from the purchaser.

Paula Richardson, the Founder of GDPR-Advisor, clarifies that a standby letter of credit works as a contingency plan or a protective measure for the recipient. In the event that the applicant fails to meet their obligations or defaults on the agreed terms, the beneficiary has the option to seek payment from the bank. Typically, standby letters of credit are used in case of long-term contracts, international trade arrangements, or large-scale projects.

The use of an SBLC is a sign of good faith as it provides proof of the purchaser’s credit quality and the sincerity of making payment.

Julia Rueschemeyer, the owner of Amherst Divorce, highlights the following advantages of Standby Letter of Credit:

- Risk Mitigation for the Beneficiary: Standby Letter of Credit provides high level payment certainty to the beneficiary as the bank will step in and make the payment if the applicant defaults.

- Enhanced Creditworthiness of the Applicant: It conveys a strong message to lenders, assuring them of the applicant's commitment to offer collateral. This assurance is particularly advantageous when entering partnerships with new or untested business associates.

3. What is an Irrevocable Letter of Credit?

An Irrevocable Letter of Credit simply means that once issued, the letter of credit cannot be revoked by the purchaser without the agreement of all the parties under the Letter of Credit. Most Letters of Credit issued nowadays are irrevocable to give the Seller assurance that it will be paid after shipping to allow the Seller to manage its credit risk.

B. Difference between Standby Letter of Credit vs. Demand Guarantee

SBLC is similar to a demand guarantee where the seller can draw from the SBLC should the purchaser fail to pay. Therefore the bank's liability is secondary in nature. Demand guarantees are used to underpin non-monetary obligations in international transactions, such as the obligations of contractors in construction contracts. However, they are rarely used by the purchaser for assurance against non-payment obligations and are usually preferred to protect against the risks of delivery of the seller.

In the US, SBLC is more frequently used instead of demand guarantees because of the sensitivity of the word "guarantee". SBLC is more an all-purpose financial tool used to support financial as well as non-financial undertakings and transactions. They have also been used on securities issuance to get a higher credit rating on the securities.

SBLC acts as an additional safety net for the seller as it ensures that even if the purchaser is unable to pay the seller, payment will still be made by the bank. That is to say, even if the original purchaser is unable to pay the seller (e.g. because of a cash flow difficulty, bankruptcy, fraud etc). As such, payment through an SBLC is usually one of last resort and is ideally never used.

C. Their Main Differences

1. Document features

How does a Letter of Credit work?

A Letter of Credit is a plain payment instrument. It has basic clauses such as documentation, packing, warranty etc. Usually, under the letter of credit, the issuing bank will agree to pay the seller given that the seller can present specified documents relating to those goods. They are issued at the request of the purchaser in favour of the seller.

Almost all letters of credit relating to international trades are expressed to be subject to the Uniform Customs and Practice for Documentary Credits (UCP) published by the International Chamber of Commerce (ICC).

Min Hwan Ahn, Esq, a New York Attorney and the Founder of EZ485, with extensive experience in commercial law where these financial instruments are commonly utilized clarifies that, in the context of a Letter of Credit, the bank initiates the payment once the predetermined conditions are met.

For demand guarantees, they are normally under the ICC Uniform Rules on Demand Guarantees (URDG):

https://iccwbo.org/global-issues-trends/banking-finance/global-rules/#1488883561675-c76b5fc1-4e8d

How does a Standby Letter of Credit work?

A Standby Letter of Credit, on the other hand, has specific performance clauses that the seller must fulfil so he can use this instrument and claim from the bank in case the purchaser is unable to pay. The bank's payment undertaking, though primary in form, is not properly invoked unless the purchaser has defaulted. The 1983 version of the UCP was extended to SBLCs.

Some SBLCs are also subject to International Standby Practices (ISP) published in 1998:

https://iccwbo.uk/products/international-standby-practices-isp98

Isla Stokes with over 10 years of experience in international trade and finance emphasizes that seller must present to the bank a demand for payment along with supporting documentation (e.g. sales contract, shipping bill of lading )to draw on the SBLC.

2. Example

As an example, Bob would like to purchase 1000 snow globes from Carrie. Carrie does not want to take the risk so she asks Bob to first obtain documentary credits from a bank in case he is unable to pay. Bob can either provide (i) a letter of credit; or (ii) a standby letter of credit from Bob's bank.

Letter of Credit Example

Bob can get his bank to issue a Letter of Credit to Carrie's bank. In order for Carrie to draw from the Letter of Credit, Carrie needs to submit the documentary proof that she has shipped the snow globes i.e. bill of lading and other shipping documents. The bank will review the documents submitted and verify their authenticity. Once verified, Bob's bank will honour its obligations by making a payment to Carrie's Bank.

Standby Letter of Credit Example

Alternately, Bob may ask his bank to issue an SBLC to Carrie. Bob is primarily obligated to make payment to Carrie upon the shipping and delivery of the snow globes. Carrie will only draw on the SBLC should Bob default on its payment obligations and such obligations would then fall on Bob's bank.

3. Issuing bank requirements

Issuing banks would agree to pay up to the value of the letter of credit. It is very favourable for the seller since it is second only to getting cash. Demand for letters of credit fluctuated over the years depending on whether it is a seller's market or a buyers' market. Ultimately it is the degree of confidence felt by the seller on the creditworthiness of the purchaser, that the purchaser's bank would be in the best position to check.

The banks incur charges for their services and the costs would be passed back to the purchaser. As such, the purchaser may be unwilling to agree to payment by letter of credit.

Fees Associated with Letters of Credit are as follows:

- The monthly fee to maintain the credit facility, whether or not the letter of credit is issued - usually a percentage of the total amount available under the letter of credit facility; and

- Fee when a letter of credit is actually issued.

In practice, the seller may not require a letter of credit for:

(i) large financially sound purchasers;

(ii) purchasers that have developed a long-term relationship of trust with the seller.

Whereas for SBLC, the bank has an obligation to pay sellers if purchasers are unable to pay. As such, banks will usually be more careful and will require collateral security from the purchaser first in order to issue an SBLC.

Both letters of credit and SBLCs are generally short-term in nature, with common terms between 30 days to 1 year. They are also recognised as “Other Eligible Support” in the ISDA Credit Support Annex.

4. Purpose and Usage

Rick Chahal, a Licensed Paralegal/Legal Assistant at Kahlon Law, explains that while both a traditional Letter of Credit and a Standby Letter of Credit are irrevocable instruments issued by banks to ensure payment, their utilization differs significantly.

Letters of Credit are used as a primary instrument of payment for individual international trade transactions, so the goal is to use this letter to complete the transaction. The issuing bank is the party primarily liable and therefore the first port of call for payment. For Letters of Credit, they are usually used in simple sale transactions for security purposes e.g. shipping imports.

On the other hand, SBLC is a secondary instrument of payment that is relied on only when the primary purchaser is unable to pay. The bank's payment undertaking, though primary in form, is not properly invoked until the principal has defaulted. It is only when something went wrong that SBLC will be used, so the goal for parties is to ideally avoid this from happening.

They are often used in projects to provide security. Moreover, with SBLC, banks have contingent obligations that arise from the letter. As such, SBLC does not support more discrete trade transactions as it does not involve the bank’s direct participation and is thereby cheaper for the bank from a capital perspective. The Bank will act as an overseer to ensure performance and the completion of the transaction.

According to Bill Ryan Natividad, Head of Operations at Finty.com, a financial comparison website, unlike conventional letters of credit commonly employed in trade transactions, SBLCs typically are not intended for the purchase of goods or services

In terms of geographical scope, Letters of Credit are usually used in international transactions where the purchaser is an importer and the seller is the exporter.

Standby Letters of Credit can be used for both international and domestic transactions, not necessarily trading-related.

Andrew Pickett, the lead Trial Attorney and Founder of Andrew Pickett Law, says that the Standby Letter of Credit has a wide range of uses and is a cost effective alternative to other forms of bank guarantee. It serves as a valuable form of security in various transactions, including construction projects, international trade agreements, and financial investments.

5. Time Period

A Letter of Credit is a short-term instrument whereas a Standby Letter of Credit is a long-term instrument. The former usually has a valid term of around 3 months and the latter has a term of around a year.

D. Simple Comparison Table - Letter of Credit vs. Standby Letter of Credit

| Letter of Credit | Standby Letter of Credit | |

| General | Contingent on the seller’s presentation of documents to show compliance | Contingent on seller’s performance and buyer’s non-payment |

| Document features | Includes basic presentation documents such as bill of lading, packing orders, and other shipping documentation (if required) | Includes specific performance clauses on the principal, which can be drawn upon default |

| Role of Bank | Checker of the Purchaser’s credibility | Obligated to pay in case of Purchaser’s non-payment |

| Usage | Primary Payment Method | Secondary Payment Method |

| Time period | Short-term upon shipping of goods | Can be longer term, typically 1 year |

E. Letter of Credit Samples

The following are some sample documents of Letter of Credit and Standby Letter of Credit, as well as their related documents:

F. Why do we need these Documentary Credits?

In both domestic and international trading businesses, risk and trust are some of the biggest challenges major challenges. By using Letters of Credit, these legal, bank-issued documents are a huge help as a safety net for sellers and purchasers as they can help ensure compliance by both parties with the terms of their trade.

Moreover, given that they are accepted and acknowledged by many countries overseas, the use of Letters of Credit will also reduce the risk of doing business abroad and facilitate transparency and trustworthiness between parties who have never worked with each other before.

Documentary Credits can provide better clarity and transparency on the transaction, as all the terms of the trade and the goods and services involved would be defined in detail in the Letter. It will bring both parties onto the same page and thus provides additional comfort to the parties as it removes any possibility of miscommunication or differing expectations.

G. Who should use these Letters of Credit?

These Letters of Credit are crucial to businesses that engage in large-volume trades, both domestically, and cross-border. They act as safety nets to lower the risk of default due to non-payment from their clients, which in turn ensures that the company will be able to earn money and maintain its cash flow. They are also very helpful in establishing trust between parties that have not worked with one another before.

Some factors may be considered when deciding whether or not to request a Letter of Credit:

-

Comparing the costs (and whose burden will these costs be on) of getting a Letter of Credit with that of the risk of non-payment

-

The legal requirements involved

-

The documentation needed to show proof of one’s compliance with the Letter of Credit (e.g. customs declaration and insurance documents)

-

The creditworthiness of the other party

H. Advantages and Disadvantages of Letter of Credit

Advantages:

- Liquid

- Simple

- Commonly used

Disadvantages:

- For beneficiaries, the risk that the issuer will become insolvent

- For issuers, payment risk if called upon to perform under the letter of credit

- For posting party, risk of expenses to replace if called upon

I. Conclusion

This guide is to facilitate the understanding of letters of credit. It provides a brief overview of the two letters’ differences and is not intended to provide a detailed legal analysis, but rather it serves as general guidance on the most important matters to be taken into account when differentiating the two.

Please note that this is just a general summary about the letter of credit and the standby letter of credit under the common law and does not constitute legal advice. As the laws of each jurisdiction may be different, you may want to speak to your local legal adviser.

Keywords: